Sole Trader Tax Invoice Template – Company owners are active individuals, as well as one of the most time-consuming jobs they have is to develop billings for their consumers. This can be a tiresome task if you don’t have a great invoice software in place. What are Invoices? An billing is an certification that is made use of to show your consumer just how much they owe you for services you have actually given. The billing additionally acts as a tip of what your customer owes you and also when they result from pay you.

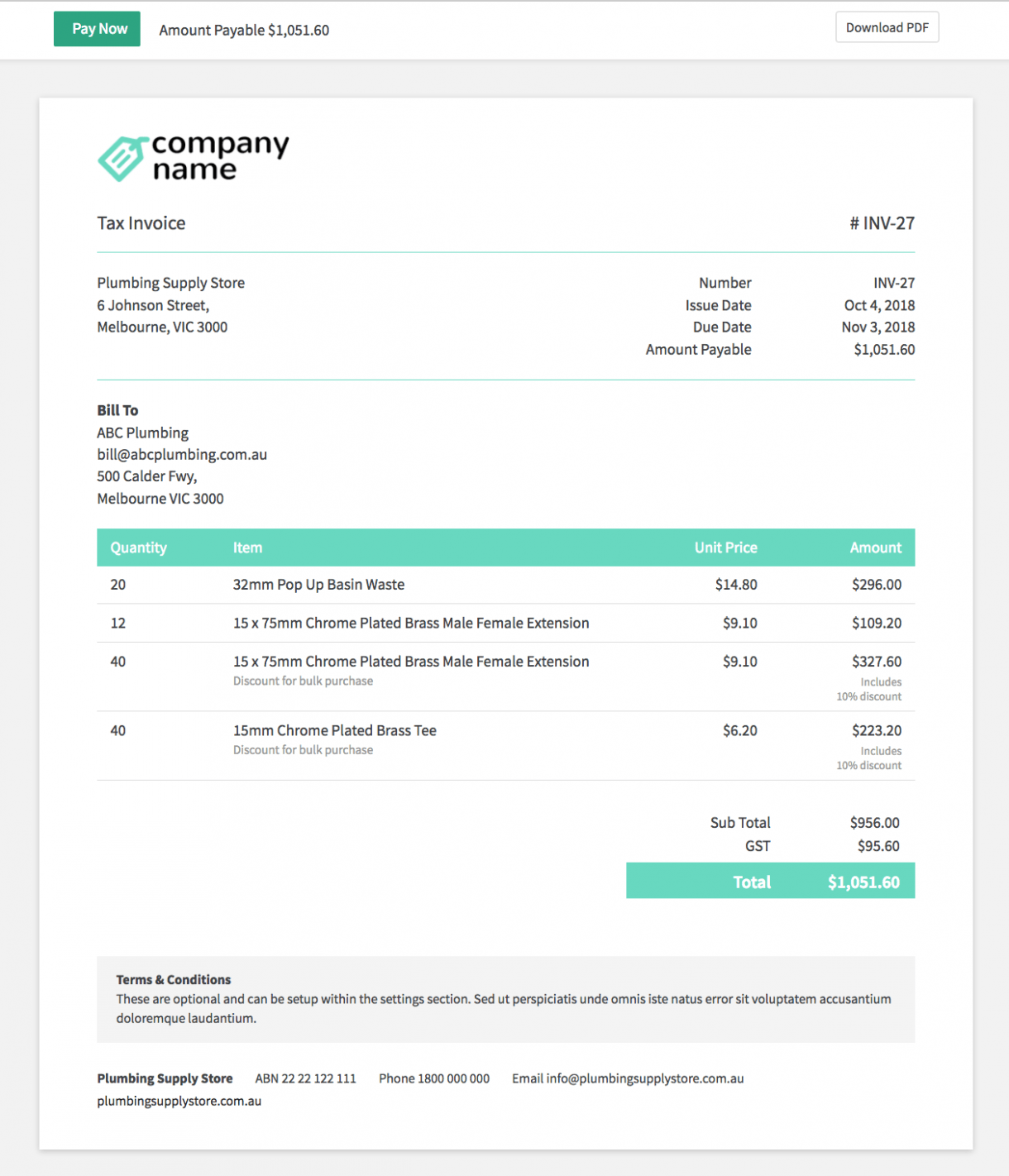

The info that should be consisted of in every billing is:

- The overall amount owed to you

- The date the repayment schedules

- A declaration of the solutions you gave

- A breakdown of any kind of extra costs such as shipping prices or sales taxes

- A statement of the terms under which your solutions were done

- Any kind of charges or fees that your consumer sustained while utilizing your solutions

The billing is used to produce a annual report and profit & loss declaration, so you have to have a excellent document maintaining system in place before creating an billing. The following are some pointers for preparing professional invoices:

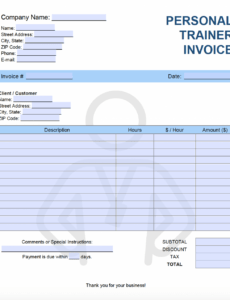

Keep your billings straightforward and easy to review. Don’t use greater than one font style as well as do not utilize fancy graphics. Use only the minimum quantity of typefaces needed to get your factor across. A great guideline is to maintain your typeface size at 10-12 points. Make certain to include your logo design on the leading left corner of the page. If the client pays by means of bank card, it is best to include a room for them to fill out their name and also address. Keep your billing easy and simple.

Consist of all the details noted above. Make certain to consist of all the details that were agreed upon when you provided the services. Make certain to ask your consumers if there is anything you can do to make things less complicated on them. Give a discount if they buy from you once again. Invoicing is one of one of the most vital facets of business administration. When done properly, an billing is the foundation for any kind of effective company. It is additionally among one of the most lengthy tasks for several businesses. As the business owner, it is your duty to create an invoice.

Using Invoice Templates

Invoice is an vital part of service. Invoice will have the info regarding your business, to ensure that customers can conveniently understand about your product and services. Invoices are sent to your clients for repayment. Invoice layout is a really crucial document which has to be prepared in advance as well as it must be tailored according to your requirements. You require to prepare invoice theme to stay clear of mistakes and misconceptions. There are various invoice themes available online which can be used to develop billing in very easy way. There are numerous advantages of using on-line invoice theme.

It conserves you time and you can manage the files from anywhere in the world. A great deal of online billing design templates are available in market. You can utilize any one of the available billing design templates but it is advised to choose the professional billing design templates. Specialist billing theme are really beneficial in making an billing look good. The billing theme must have the ideal information and must have the design according to the industry. When you are going with the invoice theme, you need to keep the layout, message as well as layout of the billing in mind. To ensure that you can get the most effective template for your business.

The billing template is the best way to make an invoice look good. The invoice theme is made by specialists who have actually been using invoice themes for many years. They can supply you with the most effective templates. They understand what looks excellent and also what does not. If you wish to make your billing look great after that you should opt for the expert billing design templates.