Sars Tax Invoice Template – Service owners are busy people, as well as among one of the most lengthy tasks they have is to develop invoices for their consumers. This can be a tedious task if you don’t have a great billing software program in position. What are Invoices? An invoice is an certification that is used to show your consumer how much they owe you for solutions you have offered. The billing likewise acts as a pointer of what your consumer owes you as well as when they result from pay you.

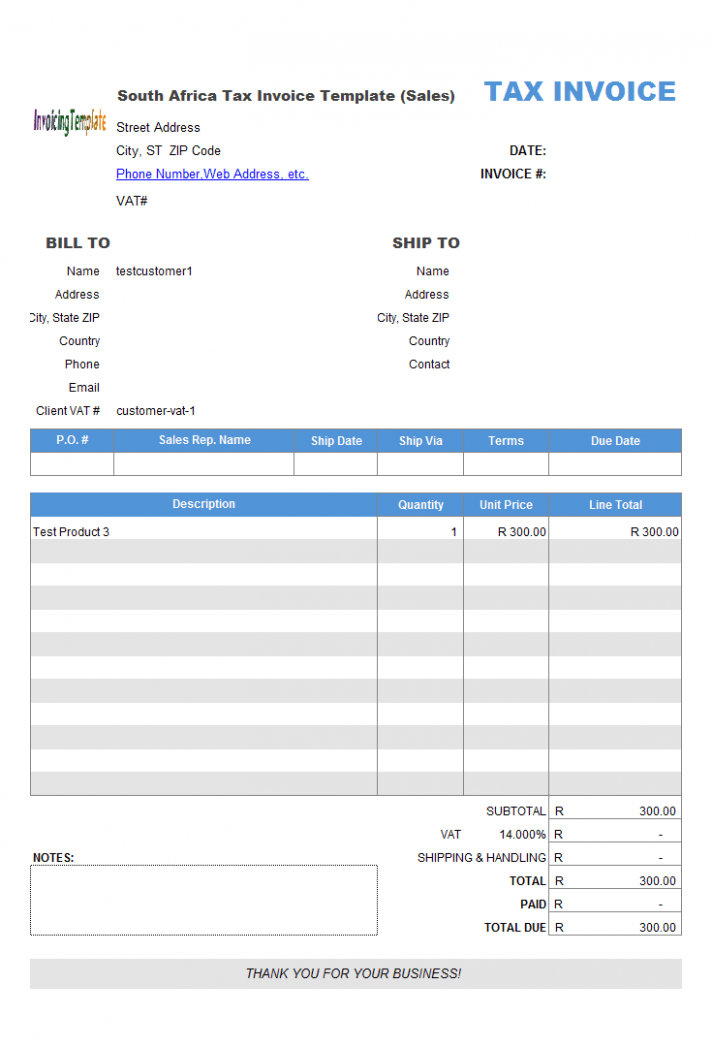

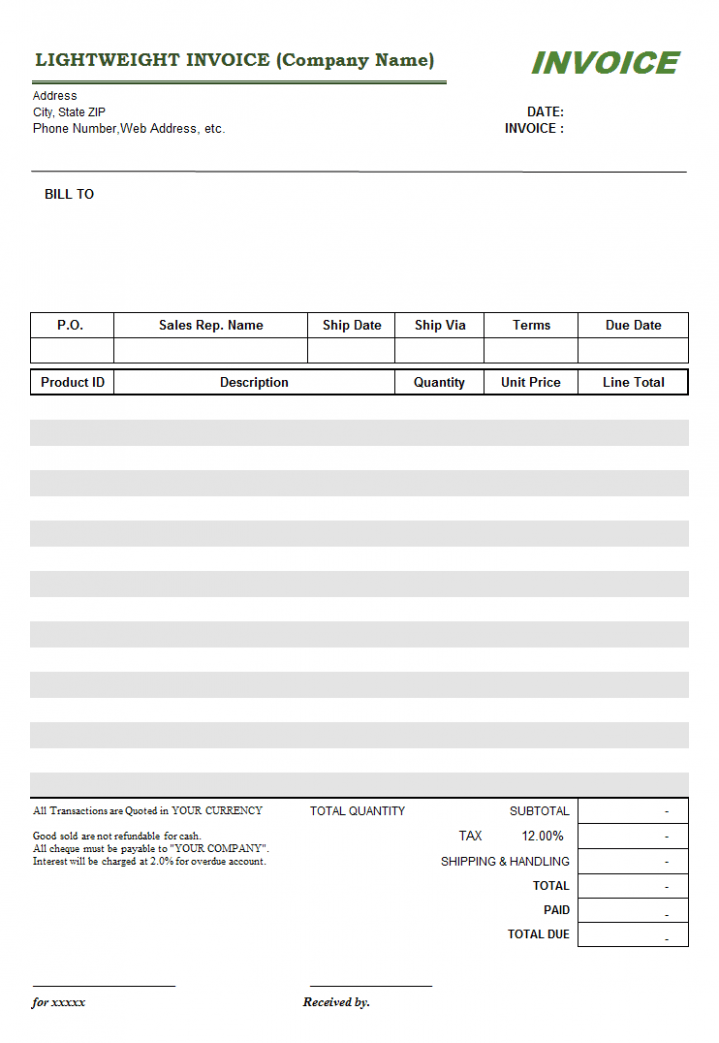

The information that must be included in every billing is:

- The complete quantity owed to you

- The date the repayment is due

- A declaration of the services you supplied

- A breakdown of any kind of added charges such as delivery costs or sales taxes

- A declaration of the conditions under which your solutions were performed

- Any fees or fees that your client sustained while utilizing your solutions

The billing is made use of to create a balance sheet as well as revenue & loss declaration, so you should have a good record keeping system in place before producing an billing. The following are some pointers for preparing professional billings:

Keep your invoices easy and simple to check out. Do not use greater than one font and don’t use elegant graphics. Use only the minimum amount of font styles required to get your point throughout. A great general rule is to keep your typeface dimension at 10-12 factors. Make certain to include your logo design on the leading left edge of the page. If the customer pays using charge card, it is best to consist of a space for them to fill in their name and address. Maintain your billing basic as well as easy.

Include all the details noted above. Make sure to include all the details that were agreed upon when you offered the services. Make sure to ask your clients if there is anything you can do to make things much easier on them. Supply a price cut if they buy from you once more. Invoicing is among one of the most important facets of organization administration. When done correctly, an invoice is the structure for any effective service. It is additionally among one of the most taxing tasks for lots of services. As business owner, it is your obligation to develop an invoice.

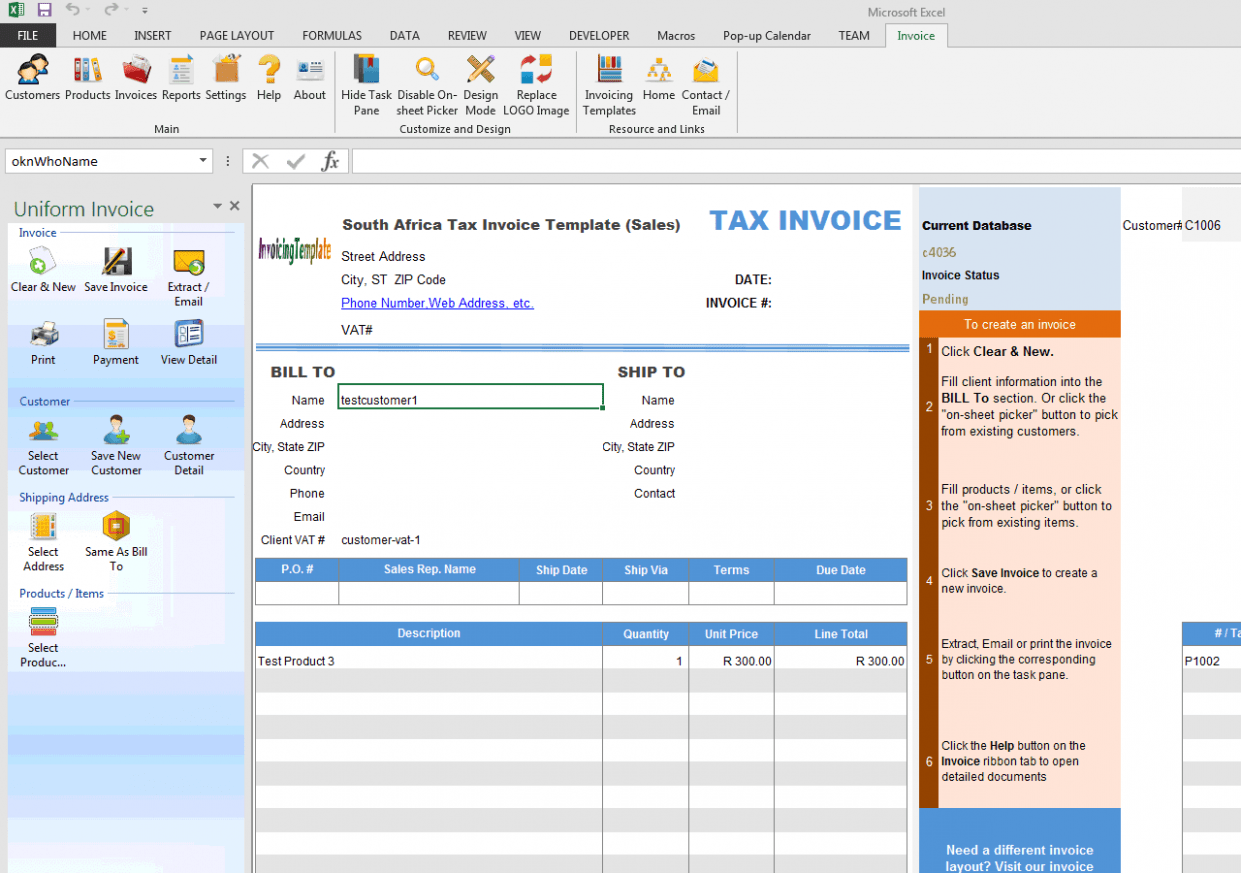

Using Invoice Templates

Invoice is an integral part of business. Billing will contain the information regarding your business, to make sure that customers can easily understand about your services and products. Invoices are sent out to your clients for repayment. Billing design template is a extremely vital document which needs to be prepared ahead of time as well as it need to be customized based on your requirements. You need to prepare invoice design template to stay clear of mistakes and also misconceptions. There are various invoice templates offered online which can be used to produce billing in very easy way. There are several benefits of using on the internet invoice theme.

It saves you time and also you can manage the files from throughout the world. A great deal of online billing themes are readily available in market. You can utilize any one of the available billing layouts but it is recommended to opt for the specialist billing design templates. Professional invoice template are really valuable in making an billing look good. The billing template must have the appropriate details and also needs to have the layout according to the industry. When you are going with the invoice layout, you have to keep the format, message and style of the invoice in mind. So that you can get the very best template for your organization.

The billing template is the very best way to make an invoice look great. The billing layout is made by specialists that have been utilizing invoice layouts for many years. They can provide you with the best design templates. They understand what looks great and what does not. If you wish to make your billing look excellent then you must choose the expert billing templates.