Australian Tax Invoice Template – Business proprietors are hectic individuals, as well as among the most time-consuming jobs they have is to create invoices for their consumers. This can be a laborious task if you don’t have a good invoice software program in position. What are Invoices? An billing is an certification that is utilized to show your consumer how much they owe you for services you have actually given. The invoice additionally functions as a pointer of what your consumer owes you and when they are because of pay you.

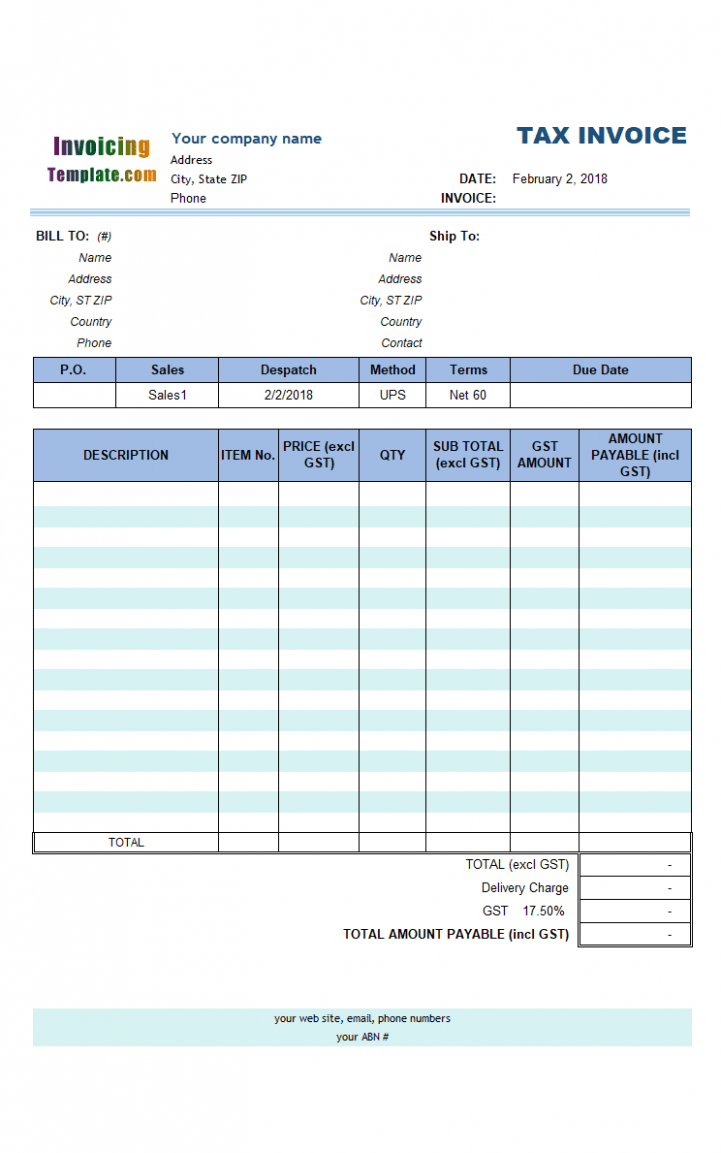

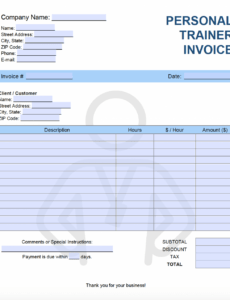

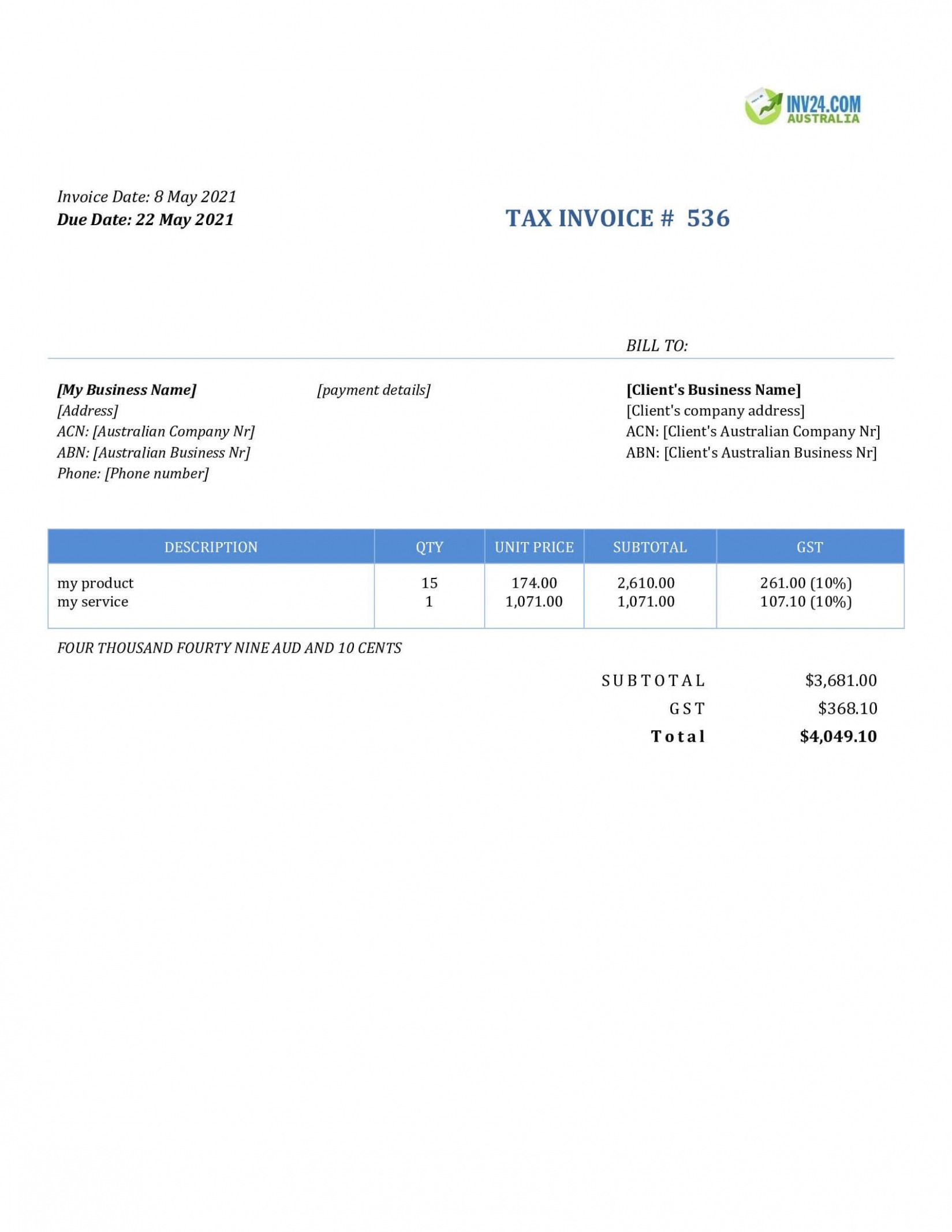

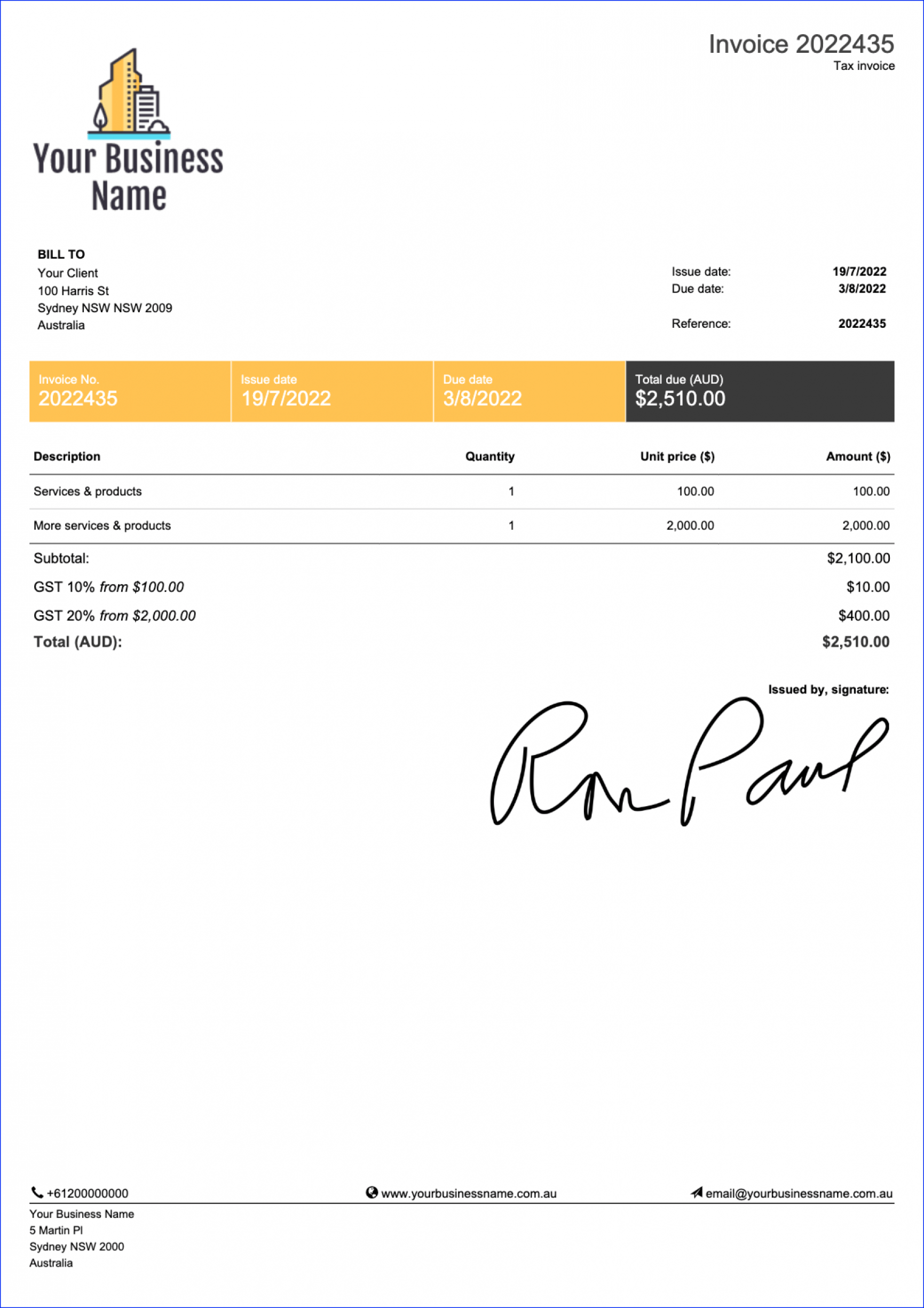

The information that must be included in every invoice is:

- The total amount owed to you

- The date the settlement is due

- A declaration of the services you supplied

- A breakdown of any kind of added costs such as delivery costs or sales tax obligations

- A statement of the terms and conditions under which your services were performed

- Any kind of fees or charges that your client incurred while using your services

The billing is utilized to produce a balance sheet and earnings & loss statement, so you need to have a good document keeping system in place before creating an billing. The complying with are some pointers for preparing expert billings:

Keep your billings straightforward as well as easy to check out. Don’t make use of more than one font and do not make use of fancy graphics. Use just the minimum amount of fonts required to obtain your factor throughout. A excellent guideline is to keep your typeface size at 10-12 points. See to it to include your logo design on the leading left edge of the page. If the client pays through bank card, it is best to consist of a area for them to submit their name as well as address. Keep your invoice simple and simple.

Include all the details noted above. Make sure to include all the information that were set when you provided the solutions. Make sure to ask your clients if there is anything you can do to make things much easier on them. Offer a discount rate if they buy from you once more. Invoicing is one of one of the most essential aspects of organization monitoring. When done appropriately, an billing is the structure for any effective service. It is also among the most lengthy tasks for several organizations. As the business owner, it is your duty to develop an billing.

Free Billing Templates

Billing is an fundamental part of company. Billing will certainly have the details about your organization, so that customers can easily learn about your services and products. Invoices are sent to your clients for repayment. Invoice design template is a extremely vital file which needs to be prepared beforehand and it should be tailored based on your requirements. You require to prepare invoice template to stay clear of mistakes and misunderstandings. There are different invoice templates available online which can be utilized to produce billing in simple way. There are lots of benefits of using on the internet billing template.

It saves you time and you can take care of the records from throughout the globe. A lot of on-line billing templates are readily available in market. You can use any one of the readily available invoice themes yet it is suggested to select the specialist billing layouts. Specialist billing design template are really useful in making an billing look great. The invoice theme must have the best info and also must have the layout according to the sector. When you are going for the billing design template, you have to maintain the design, message and design of the invoice in mind. So that you can get the best layout for your company.

The invoice design template is the most effective method to make an billing look good. The billing layout is made by professionals who have actually been utilizing invoice templates for years. They can provide you with the very best design templates. They recognize what looks great and what doesn’t. If you want to make your invoice look excellent then you must select the professional invoice layouts.