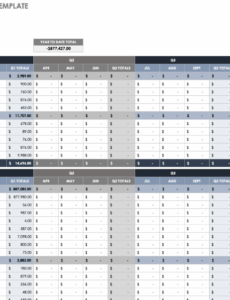

Non Profit Financial Plan Template – Service is an organized method of earning money. It is a system that enables the business owner to arrange, framework and also control his […]

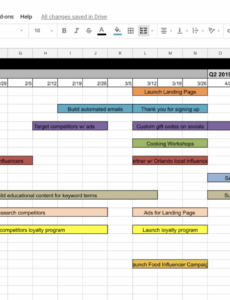

Marketing Plan Schedule Template

Marketing Plan Schedule Template – Organization is an well organized means of earning money. It is a system that permits the entrepreneur to arrange, structure as well as control his/her […]

Spanish Unit Plan Template

Spanish Unit Plan Template – Service is an well organized way of making money. It is a system that enables the business owner to arrange, framework and also regulate his […]

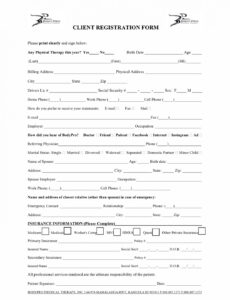

Physical Therapy Order Form

Physical Therapy Order Form – Restraining orders are orders provided by a court that restrict individuals or entities from taking certain activities. In separations they are generally utilized to reduce […]

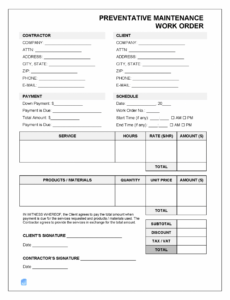

Mission Order Template

Mission Order Template – Limiting orders are orders provided by a judge that ban individuals or entities from taking particular actions. In divorces they are frequently made use of to […]

Garnishee Order Template

Garnishee Order Template – Restraining orders are orders released by a judge that ban individuals or entities from taking specific actions. In divorces they are typically made use of to […]

Clean Break Order Template

Clean Break Order Template – Restraining orders are orders released by a judge that restrict individuals or entities from taking particular activities. In divorces they are frequently utilized to reduce […]

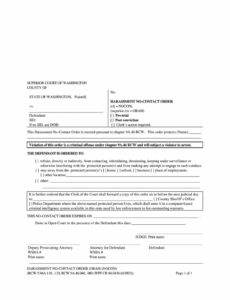

No Contact Order Template

No Contact Order Template – Restraining orders are orders released by a court that prohibit people or entities from taking certain actions. In separations they are commonly utilized to lower […]

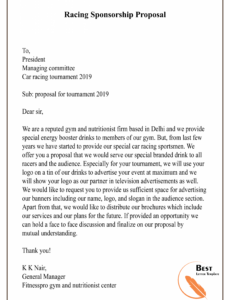

Sponsorship Offer Letter Template

Sponsorship Offer Letter Template Taxpayers experiencing tax financial obligation problems rarely compare the internal revenue service deal in concession with the Phase 13 insolvency. Often, the Chapter 13 will offer […]

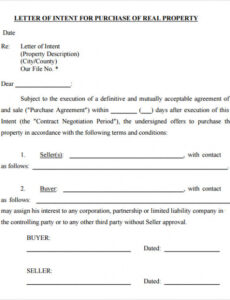

Purchase Offer Letter Template

Purchase Offer Letter Template Taxpayers experiencing tax financial obligation troubles seldom compare the internal revenue service offer in compromise with the Phase 13 insolvency. Often, the Phase 13 will certainly […]